Example:

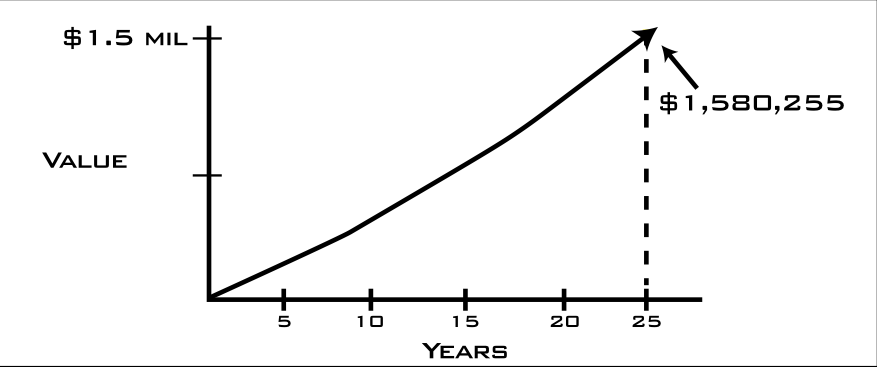

A 40 year old member of the plan looking to retire at age 65, invests the 401K maximum of $19,500 annually, then $26,000 from age 50-65 and the company matches 25% of the investment. The value of the retirement plan would be $1,580,255 invested at an average of 6%.

In addition, the company match is tax deductible and the employee contribution is tax deferred.

Entrepreneurial Success Plan helps you:

• Lower your Tax Burden

• Ensure Compliance with California’s

Complex Employee Rules

• Understand your Business’s Results

• Improve Overall Cashflow

• Provide for Retirement- Accumulate over

$1.5 million over 25 years

Premier Tax and Finance’s Entrepreneurial Success Program allows you to concentrate on your company’s operations, leaving the administrative hassles for us.

6 STEPS TO SUCCESS

Step One – Choose the correct entity structure

The appropriate structure depends on certain circumstances -The contemplated revenues/profits expected to be derived, the management/employee make up, and the exit plan. In some cases, a “C” Corporation is best when a longer-term exit and sale of the company is contemplated. A “S” Corporation may be appropriate to mitigate employment taxes that are 15.3% of profit on top of income taxes- for example $100,000 profit would cost $15,300 in additional tax. (See step 6)

Step Two – Account for your transactions

Maintain appropriate business records in a program that can help shape financial statements on at least a quarterly basis.

Step Three – Know your company’s results

Review and analyze your company’s financial statements at least quarterly (monthly is best). Look for trends and relationships between revenues and costs to generate those revenues. Assess what products or services that are bringing in the most profit.

Step Four – Be Compliant with State Labor laws

California has many requirements for companies with as few as five employees. Non-compliance can be very costly.

Step Five – Improve cashflow through effective tax planning and strategy

Your tax burden (Federal and State) can be over 50 % of your profit, so effective communication with your tax preparer is vital to determine the appropriate method of accounting, timing of purchases, and other strategies to hold on to as much cash as possible.

Step Six – Plan for the future

Many entrepreneurs are so busy working on the business, they fail to properly plan for retirement and then have to extend their working lives to be able to make ends meet. Under this program we take the cash you would have paid for employment taxes and redirect this into a 401K plan where YOU have control.