Articles

All

Announcements

Articles

Individuals

Resource

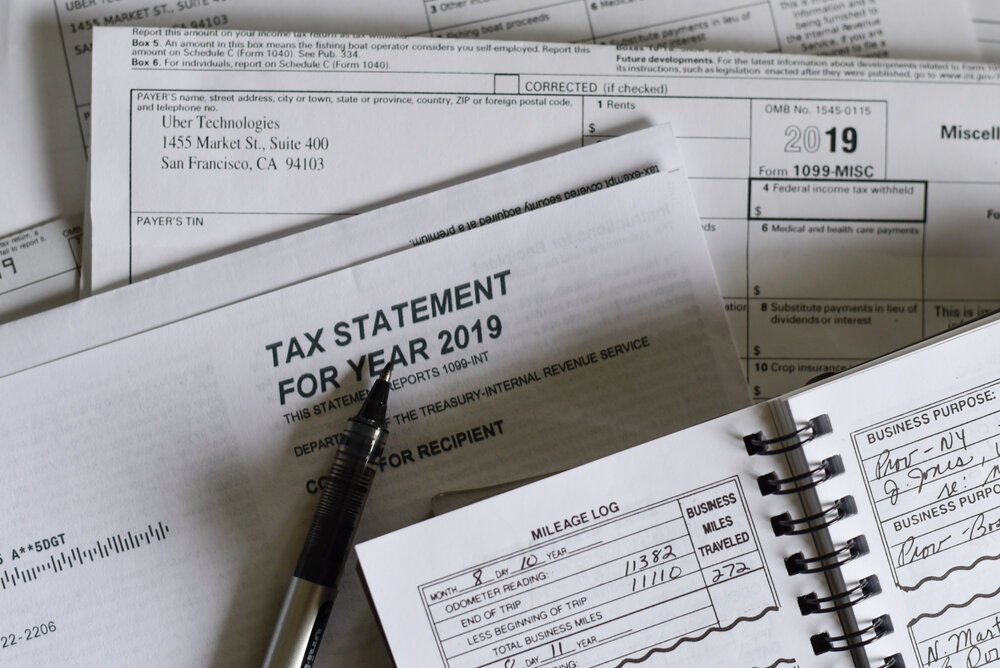

Tax Preparation

Tax Representation

Financial Reporting

Financial Management

Business Services

Planning Services

Load More

Load More

Load More

Load More

Load More

Load More

Load More